Hello and welcome to the 2nd official newsletter of the year.

What a week for traders. While the volatility surely spiked the premiums in our favorite covered call funds, it was a white-knuckle ride.

President Trump’s comments initially sent the market spiraling on Tuesday, but someone must have whispered in his ear. He was very verbal, making deals very fast—stabilizing the markets just in time. But for us income investors, that "save" came with a catch.

We saw a classic "V-Shape" recovery. For covered call funds, this is often the worst-case scenario: we take the full hit on the drop, but our upside is capped on the rip back up. The result? You might see some NAV erosion this week despite the market recovering.

The Shakeout is Real It’s not just market mechanics we have to worry about. We are seeing a major cleanup in the industry, with Defiance quietly delisting several of its high-yield funds this month. (We dig into why this is happening in our feature article below).

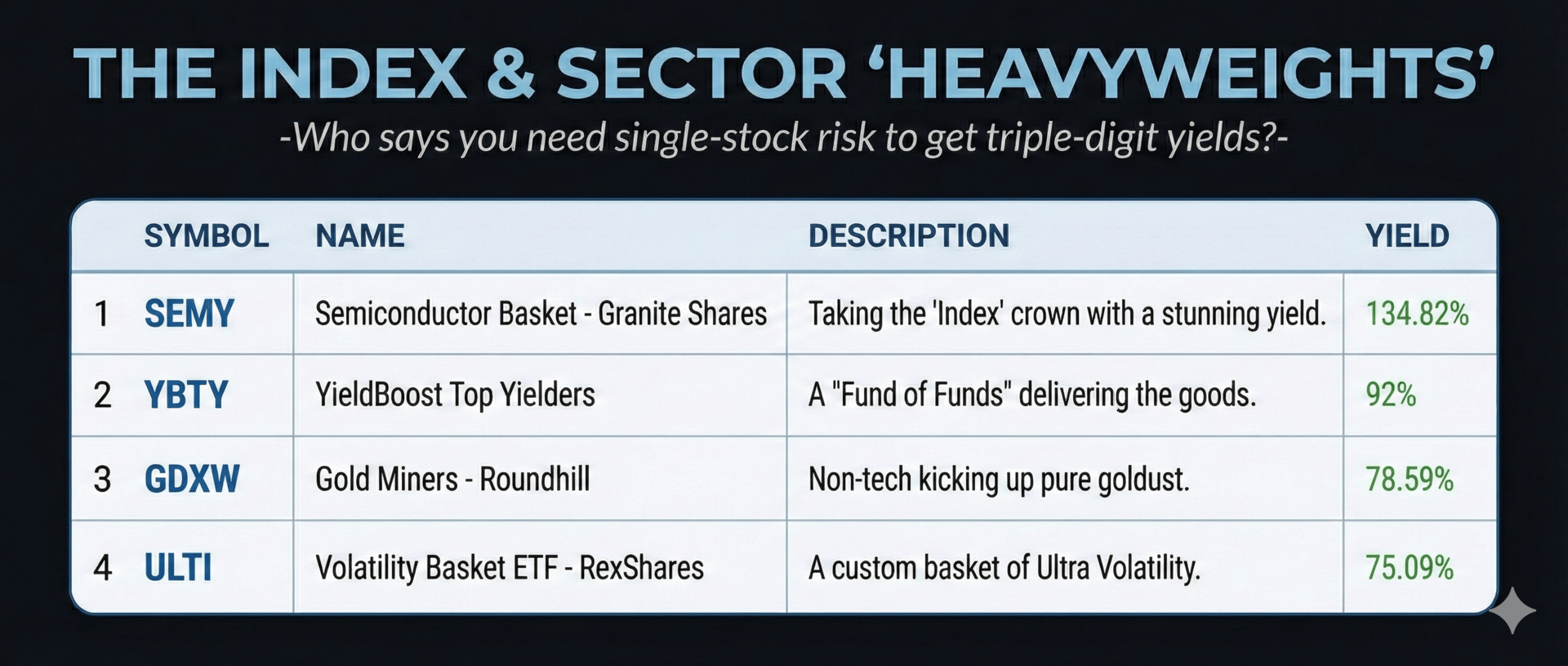

The Silver Lining? Volatility is still the fuel for our income engine. That chaos spiked option premiums across the board, resulting in some massive projected yields—specifically in the Crypto and Semiconductor sectors.

Let’s cut through the noise and see our leaderboard.

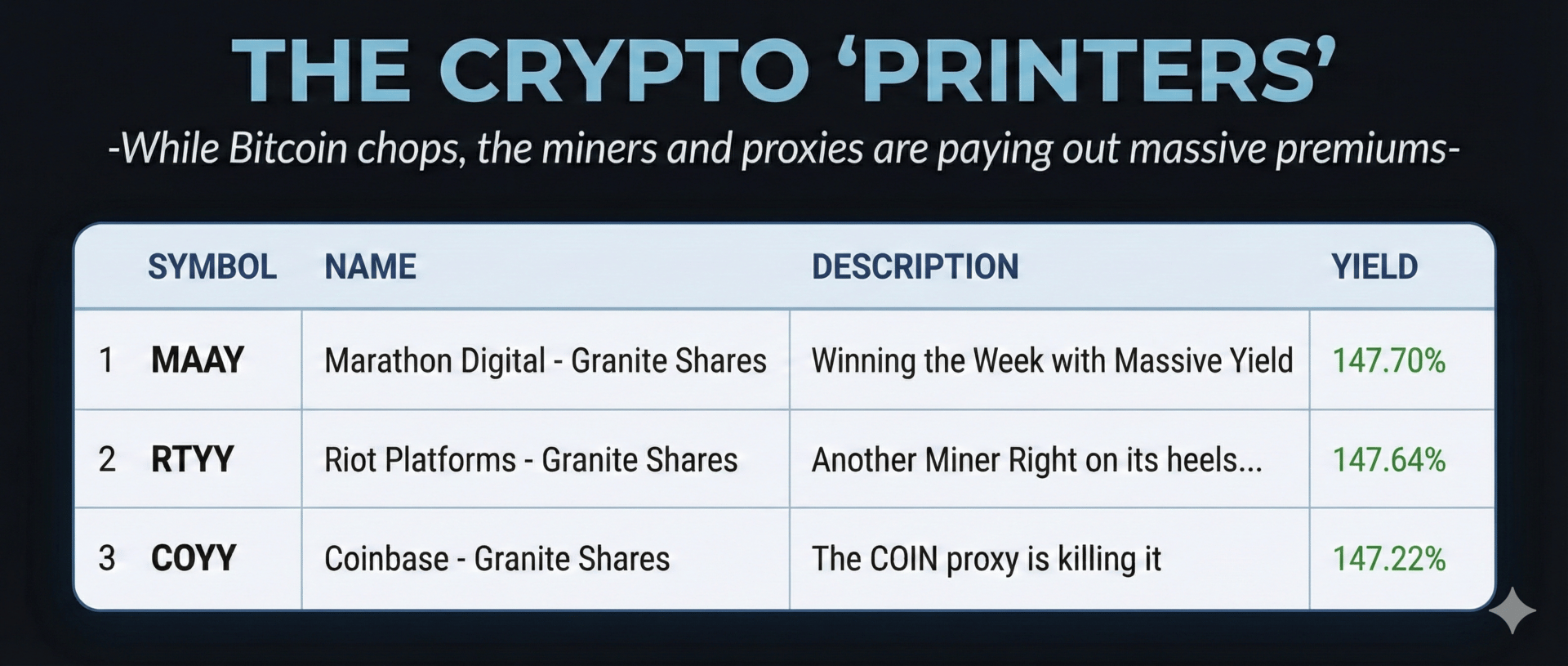

If you needed proof that volatility equals yield, look no further than the Crypto and Crypto miner funds (or are they datacenter funds now?). While Bitcoin chopped sideways, the proxies went parabolic in premium generation.

Sector Watch: It’s not just crypto. SEMY (Semiconductors) is the quiet achiever, delivering nearly 135% yields but time will tell how the NAV holds up on this ETF as this fund is relatively new.

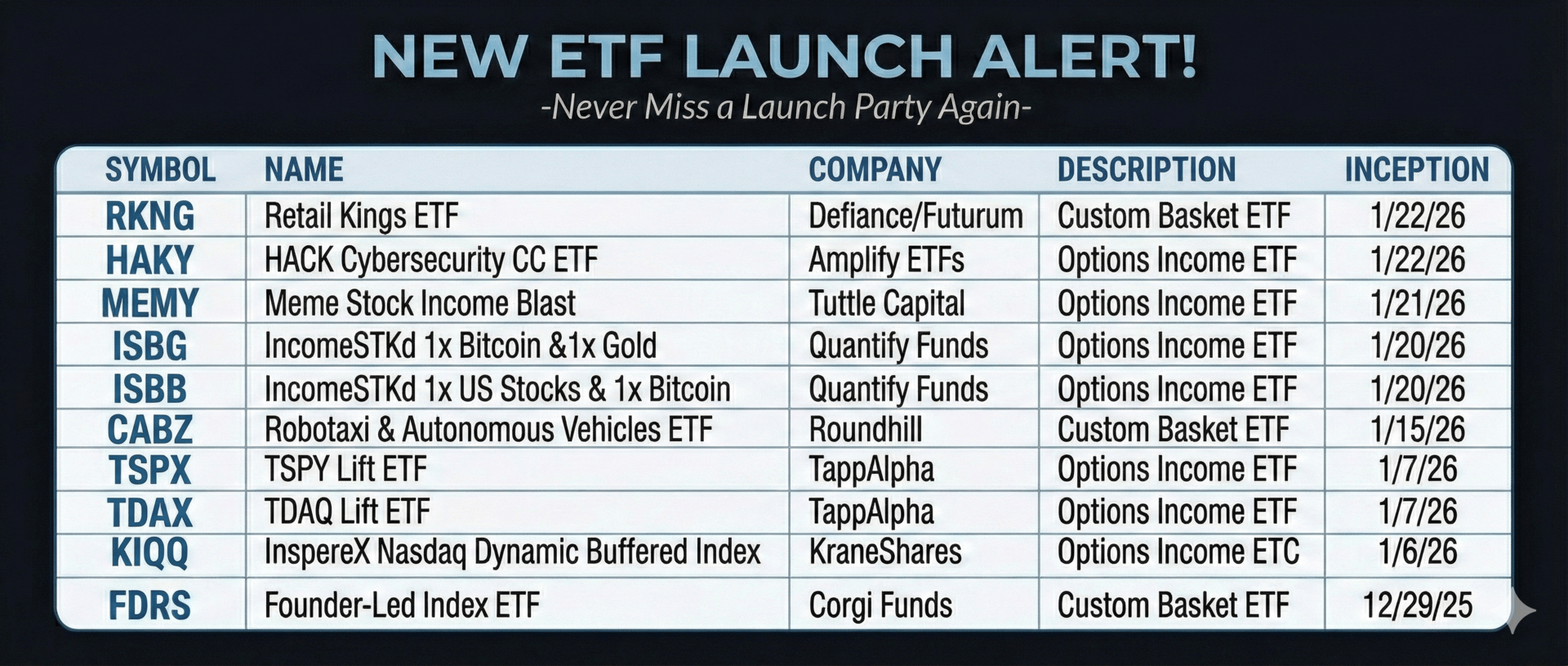

Fresh Paper Hitting the Market The ETF machine doesn't stop. We have some aggressive new entrants hungry for market share.

All Eyes on Matthew Tuttle The man who loves to disrupt Wall Street is back, and he is determined to prove that (in his words) most Covered-Call ETFs SUCK!

Tuttle Capital just released MEMY, an actively managed fund targeting the volatility of "meme stocks" to generate yield. Unlike typical rules-based funds, Tuttle aims to use a more complex, active options strategy to navigate the chaos. Tuttle capitals portfolio is growing fast. MEMY is Tuttle’s fourth ETF under their own brand having also recently released MAGO on December 30th.

Tuttle Capital has also partnered with TappAlpha to supercharge two of the industry’s underdogs: TSPY and TDAQ.

The New Tickers: TSYX (S&P 500) and TDAX (Nasdaq-100).

The Strategy: These new funds take the successful daily options engine of the underlying funds and add 30% leverage (1.3x). It’s a "Goldilocks" amount of juice for investors who want more income than the standard funds but aren't ready for the 2x risk of a Defiance fund. You can read what happens when an income fund becomes overleveraged in the article below. This partnership is definitely one to watch.

Want to see a list of all high-yield funds in one place? Stop hunting for yields across a dozen different websites. Get every distribution, for every fund, right now using the Master List.

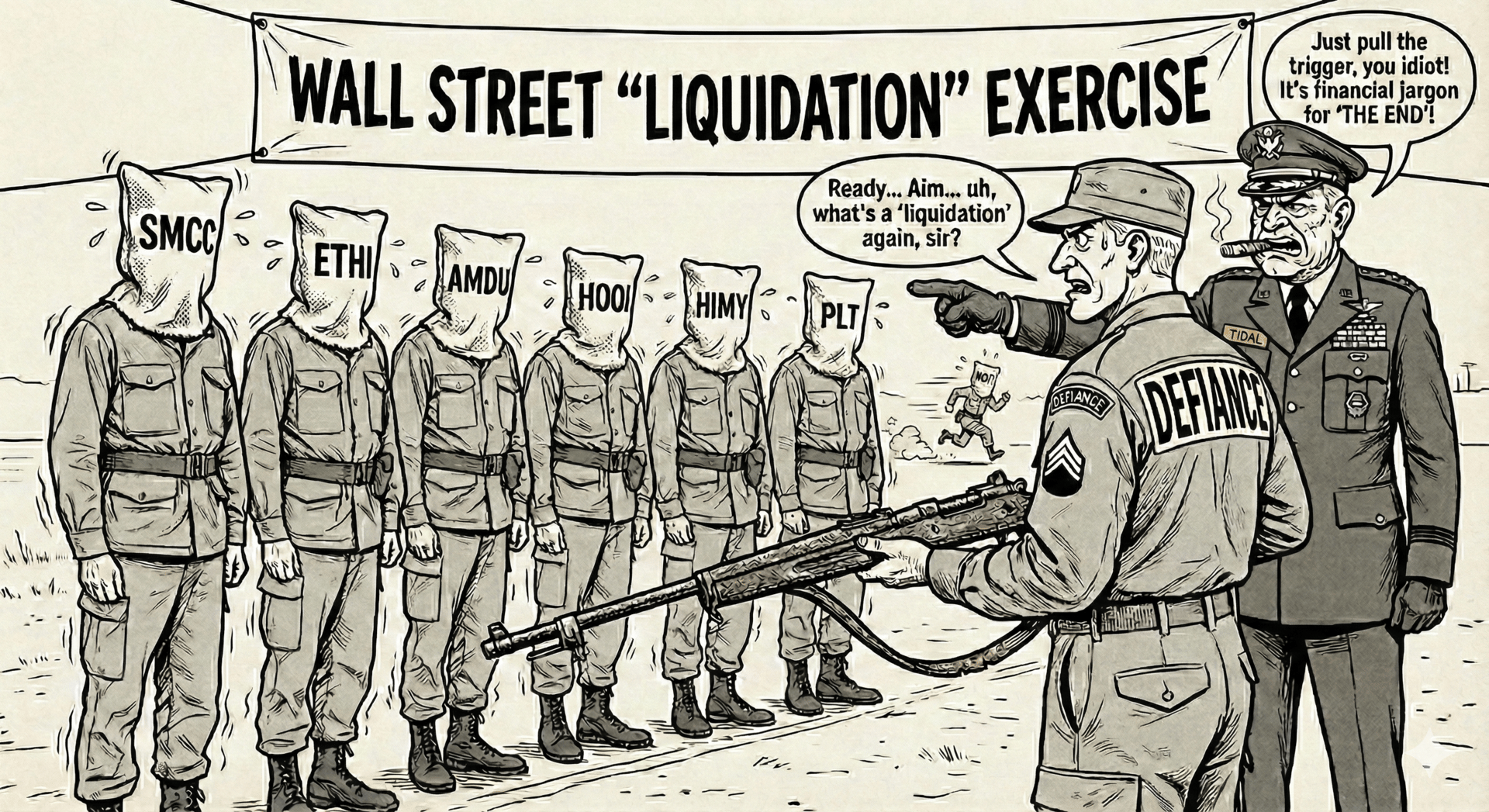

Defiance Puts Own ETFs to the firing Squad

The Rise and Fall of Defiance’s Single-Stock High-Yield Experiment

In a move that has shaken the high-yield community, Defiance ETFs, in partnership with Tidal Financial Group, officially announced on January 16, 2026, the liquidation of eight funds. This (almost) marks the effective end of their "Leveraged Long + Income" product line.

We are talking about a near-total wipeout. PLT, SMCC, HOOI, AMDU, HIMY, ETHI, TRIL, and LLYZ are all facing the firing squad. The last day to trade is January 26, and full liquidation follows on January 30. There is one survivor-for now. I will get to that shortly.

I started this site with a specific goal in mind—you can see it in my "About" section: I wanted to be the "first to find out who crumbles." It brings me no joy to report that in early 2026, it's an old favorite like Defiance that's forced to adapt its strategies amid tough market realities.

The Path to Cannibalism

Defiance launched this lineup in 2025 with an original vision: marry the growth potential of a leveraged ETF (think 2x plays like TSLL) with weekly income from options overlays. It was positioned as an evolution of their broad-market yield funds, offering retail investors amplified upside plus cash flow. On paper, it sounded innovative. But it set up a perfect storm of risks.

All the risks(and goals) were clearly defined in the prospectus: long-term capital appreciation via leverage (using swaps and derivatives) and current income, often distributed as return of capital (ROC) to maintain high yields. Fees ranged from 0.99% to 1.15%, plus trading costs. Risks were explicit—leverage could double losses, volatility might undermine options, and ROC erodes net asset value (NAV) over time, potentially leading to total depletion without growth or inflows

Or in other words…..

What happens when an underlying stock drops by 10% - its 2x counterpart drops by 20%. Now add an options strategy (credit call spreads) that generates income but caps potential upside. Factor in bad launch timing this was in-fact the perfect storm.

High yields of 70-100% sound appealing, but they're frequently just ROC—returning your principal. Without strong underlying performance to outpace these payouts, the fund effectively cannibalizes its own AUM(Assets Under Management):

Scenario A: You have $1 Billion AUM. You pay out 50%. The stock stays flat. Next year you have $500 Million AUM, assuming no inflows.

Scenario B: You have $5 Million AUM. You pay out 80%. The stock drops. You now have $800k AUM. The fund closes.

Defiance's dynamic leverage plus options was ambitious, but they launched into a choppy market. The erosion killed the NAV, and poor underlying performance likely led to retail fatigue which killed the inflows.

It’s All About ETF demand

Why delist now, when other high-yield funds have limped along worse? I was shocked too, assuming hype around underlyings like Palantir, AMD, and Ethereum would sustain them. But numbers don't lie—it's all about AUM.

If customers aren't buying the ETF, the fund has no assets. The expense ratio (the fee you pay to hold the fund) is what pays the bills—legal, administrative, trading costs. If the AUM is too low, the fees generated can't cover the electric bill, and management has to pull the plug.

Want to analyze these funds yourself? Visit RetailInvestorReport.com to access the High Yield Terminal and master dividend investing today!

Disclaimer: This newsletter is for informational and entertainment purposes only and does not constitute financial advice; please consult a qualified professional before making investment decisions.