I think it’s time we talk about XPAY from Roundhill.

I’ll be honest—my research into this fund started with a moment of total confusion. I received a distribution email from Roundhill, and I opened it expecting to see the usual weekly numbers to update my tracking spreadsheet. Instead, I was staring at a distribution schedule for XPAY for the ENTIRE YEAR.

I paused. How could this be?

I initially assumed XPAY was just another covered call ETF targeting a 20% yield on the S&P 500, similar to the funds we see from YieldMax or Defiance. Usually, those funds calculate distributions weekly or monthly based on current volatility. But here Roundhill was, telling me exactly what they were going to pay me in December... back in January.

It was time to dig in.

The Mechanism: A "Target" Distribution

Here is what I learned: XPAY doesn't pay you based on this week's option premiums. Instead, the fund takes the NAV (Net Asset Value) at the start of the year, calculates 20% of that number, and locks it in as the "dividend target" for the next 12 months. They simply chop that number into 12 equal payments, and there you have it—your income for 2026 is set.

This makes XPAY unique. Most competitors, like the Defiance S&P 500 Income Target 20 ETF (SPYT), target a 20% annual rate based on the current daily or weekly value of the S&P 500. XPAY anchors its payout to the past (the start of the year).

It’s a fascinating structure, but it immediately raises the million-dollar question: Where does the money come from?

If the fund commits to paying you 20% of its starting value no matter what, what happens if the market has a bad year? Or even just an "okay" year?

Let's look at the math. The fund claims to pay an annualized rate of 20% of the year's starting NAV.

Scenario A: The S&P 500 goes up 25%. The fund makes enough profit to pay you your 20% and grow the NAV by 5%. Everyone wins.

Scenario B: The S&P 500 goes up 10%. The fund pays you 20%. Since it only earned 10% from the market, the remaining 10% comes out of your principal. The NAV erodes.

This brings us to 2025. The S&P 500 had a solid year, returning roughly 17.9%. So, did XPAY’s NAV go up?

No.

Because the management team had to payout that massive 20% target they baked into the plan, they were fighting an uphill battle. Since the underlying index (17.9%) did not exceed the distribution target (20%), the NAV naturally eroded to cover the difference.

Whats the Upside?

The upside is exactly that.

The Upside!

Most high-yield funds are "Covered Call" ETFs. To generate cash, they sell call options, which effectively puts a "ceiling" on how much money you can make. If the market rips 5% higher in a month, a covered call fund might only give you 1% of that growth.

XPAY is different. It is not a traditional covered call ETF.

Roundhill operates this fund by buying deep-in-the-money FLEX call options on the SPY (which moves 1:1 with SPY, giving them full exposure to the market's moves) and periodically selling them to generate the cash for your distribution.

This means XPAY’s upside is not capped. If the S&P 500 rockets up 40%, XPAY goes up with it (minus the cash it distributes).

But gravity works both ways.

If the S&P 500 drops 20%, XPAY takes a double hit. It loses 20% from the market drop, plus it still extracts that 20% cash distribution from the fund's assets. This means while the S&P is down 20%, your XPAY share price (NAV) could end the year down nearly 40%. You still have the cash in your pocket, but your principal investment has been severely cut down.

The Bottom Line: Context is King

This brings us back to the golden rule of retail investing: there is no magic bullet.

Success with a fund like XPAY isn't just about the yield—it’s about when you buy and how you layer it into your portfolio. If you buy at the top, the erosion can hurt. But if you treat it as a specific tool for cash flow within a diversified strategy, it can be a powerful engine.

As always, don't just chase the yield—understand the mechanic.

See It In Action

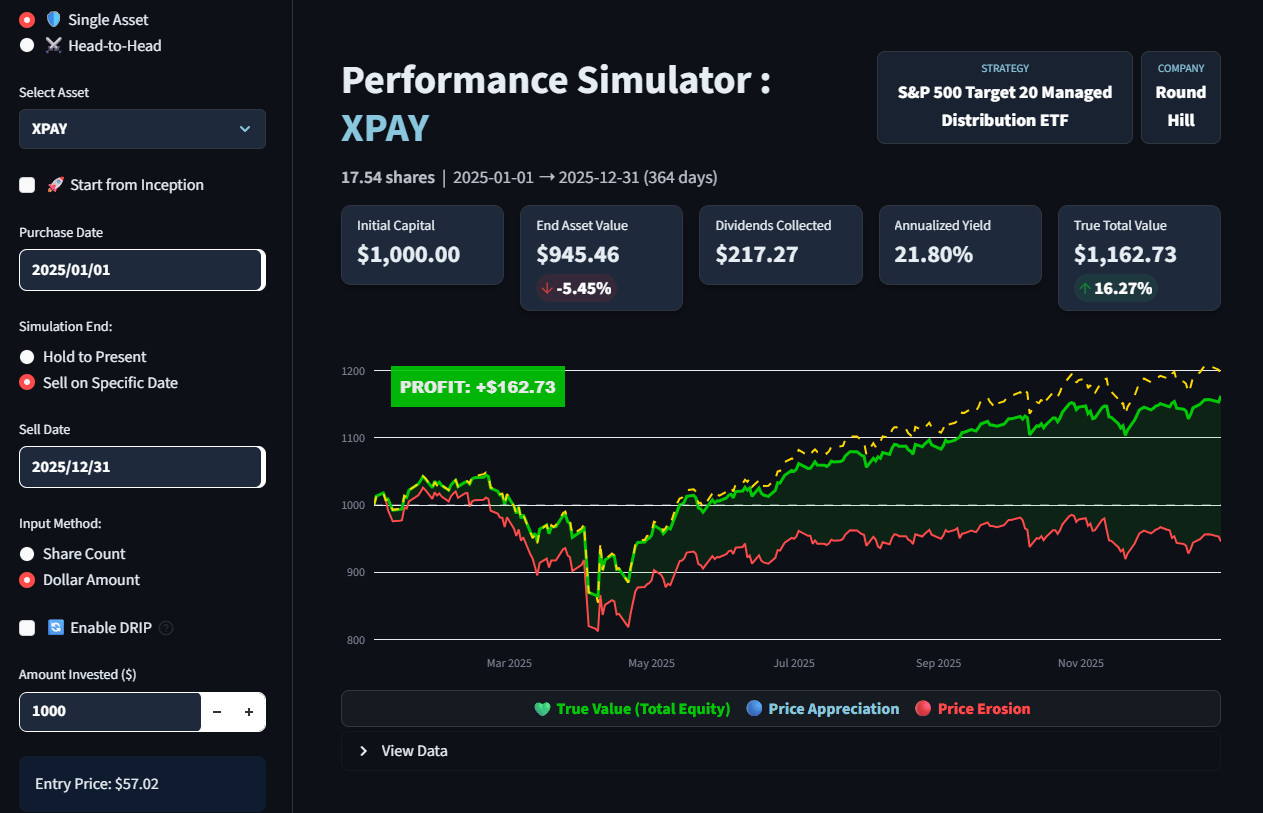

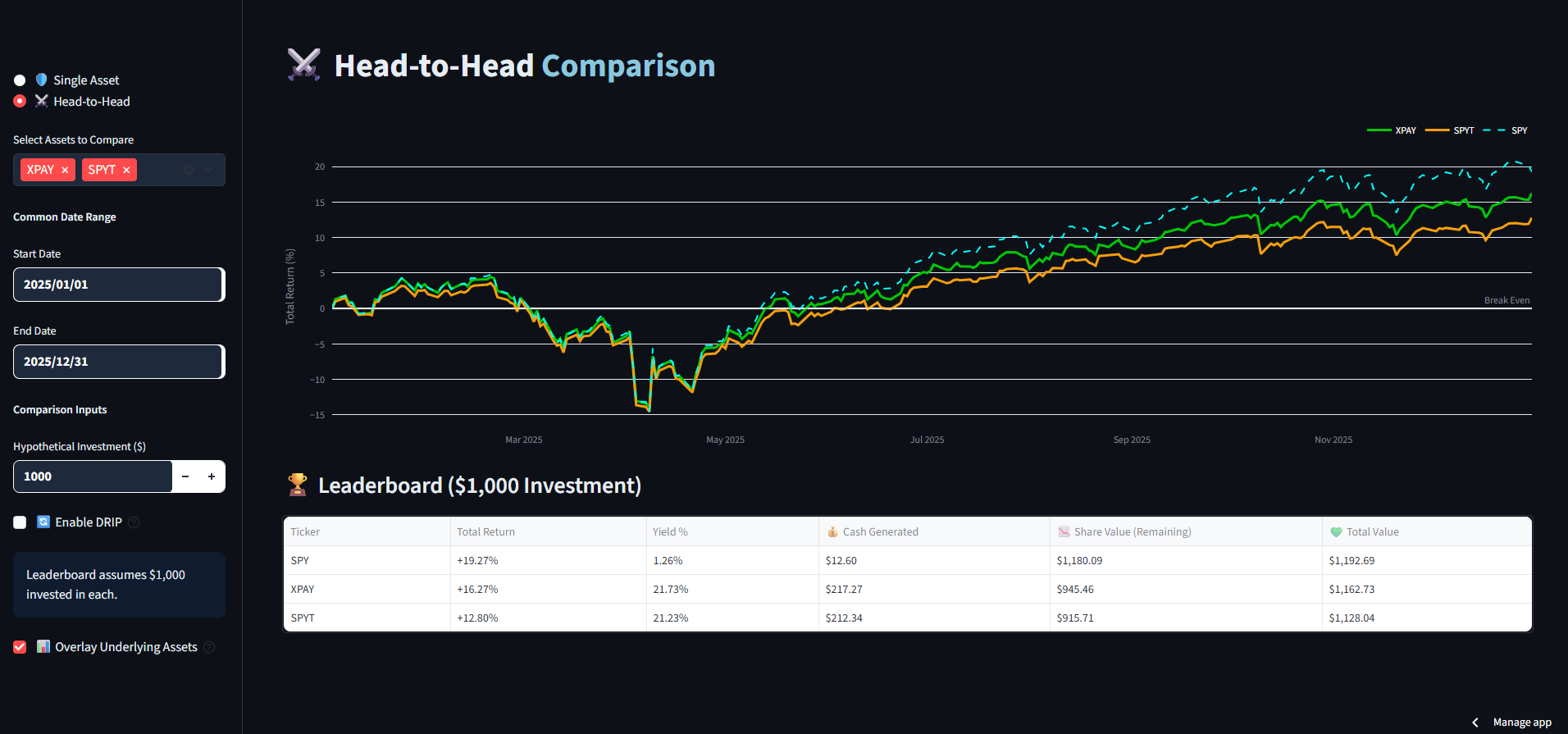

Above, you can see the performance of XPAY over the last year using The High Yield Terminal App.

Has the NAV eroded? Yes. Looking at the chart, we can clearly see the share price dropped by 5.45% over the year.

However, the fund succeeded in its objective: it delivered the massive 21.8% yield to investors. In my opinion, 2025 was a stellar year for XPAY. It proved that you can receive high income without sacrificing your exposure to a bull market.

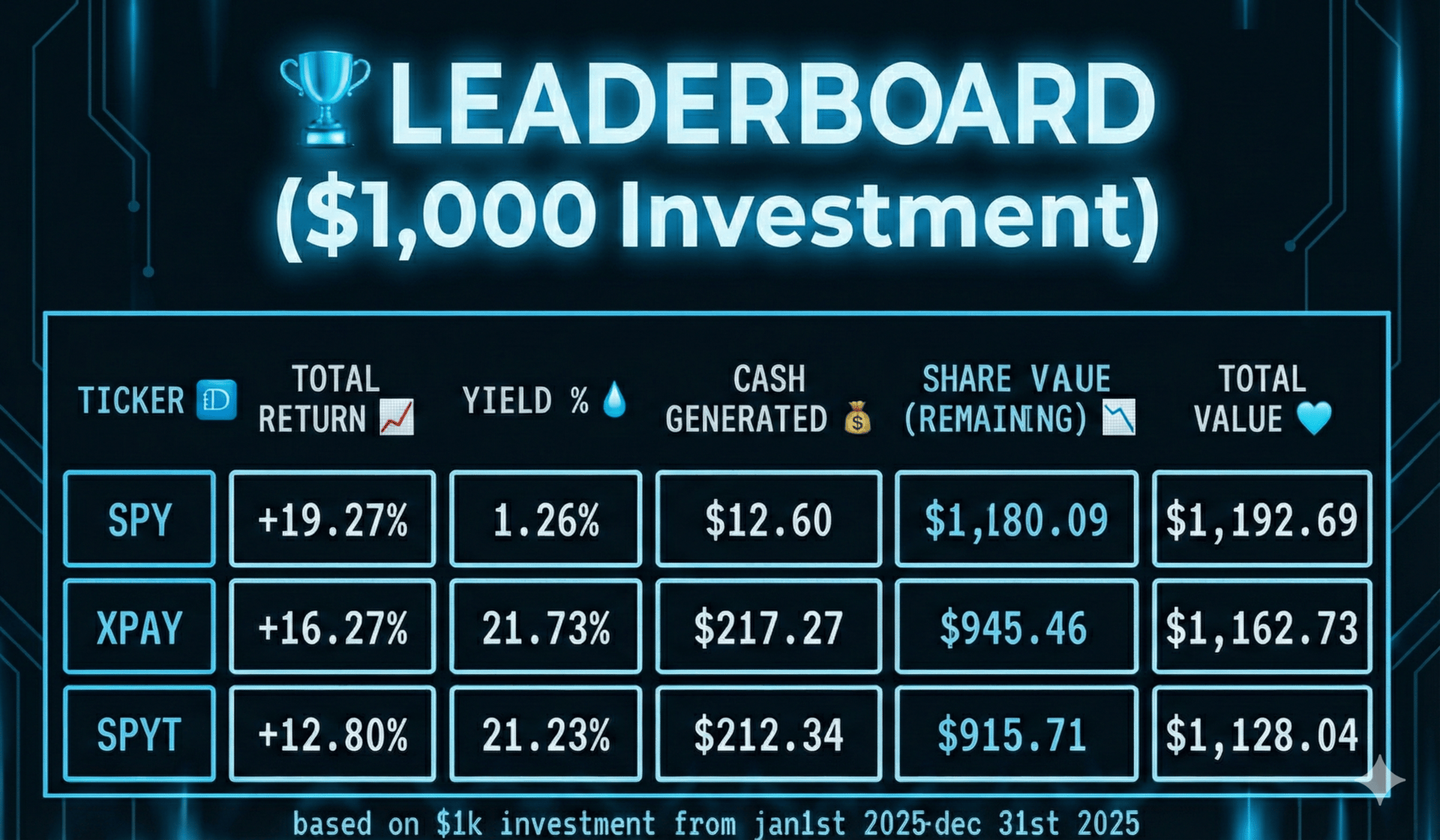

The Face-Off: XPAY vs. SPYT

Let’s compare this to a similar vehicle: SPYT (Defiance S&P 500 Income Target ETF).

SPYT also targets a 20% yield, but it achieves this by selling credit spreads. This strategy inherently caps your upside. When we look at the data from 2025, the difference is clear:

Screenshot of the Head-to-Head Comparison tool in The High-Yield Terminal App

SPYT (Capped): Struggled to capture the full market rally because of its option caps.

XPAY (Uncapped): Captured the market rally, allowing the NAV to stay much healthier despite the heavy distributions.

Based on $1000 investment on Jan 1st 2025 and ending on Dec 31st - Both Funds delivered a fantastic 21% yield with only $5 between the two but as you can see from the numbers above the NAV and Total Return is a little higher when compared to SPYT.

The Verdict: In this reporter's opinion, we have a clear winner. If I am going to hold a target-20% vehicle, I want the one that doesn't punish me when the market rips higher. I’m picking the fund with the uncapped upside.

Only time will tell how XPAY handles a bear market, and I’ll be sure to do another review next year. But for now, it’s earned a spot on my watchlist.

Want to analyze these funds yourself? Visit RetailInvestorReport.com to access the High Yield Terminal and master dividend investing today!

Disclaimer: This newsletter is for informational and entertainment purposes only and does not constitute financial advice; please consult a qualified professional before making investment decisions.