What a week. With all the craziness in the precious metals arena, you might almost forget that META ripped 10% and MSFT dipped 10% on the same day.

The week started with three days of pure "Gold Fever" and "Silver Squeeze" momentum. Gold touched record highs of nearly $5,600/oz and Silver topped $121/oz on Thursday.

The stock market dipped Thursday primarily due to Microsoft's 10% plunge on concerns over high AI spending and slowing cloud growth dragging the Nasdaq and QQQ lower. Meanwhile, the Fed's expected rate pause amid somewhat elevated inflation reinforced a "higher for longer" stance. It should be noted that at this point the indexes likely held overweight positions in Gold and Silver, driven by their substantial, recent rallies.

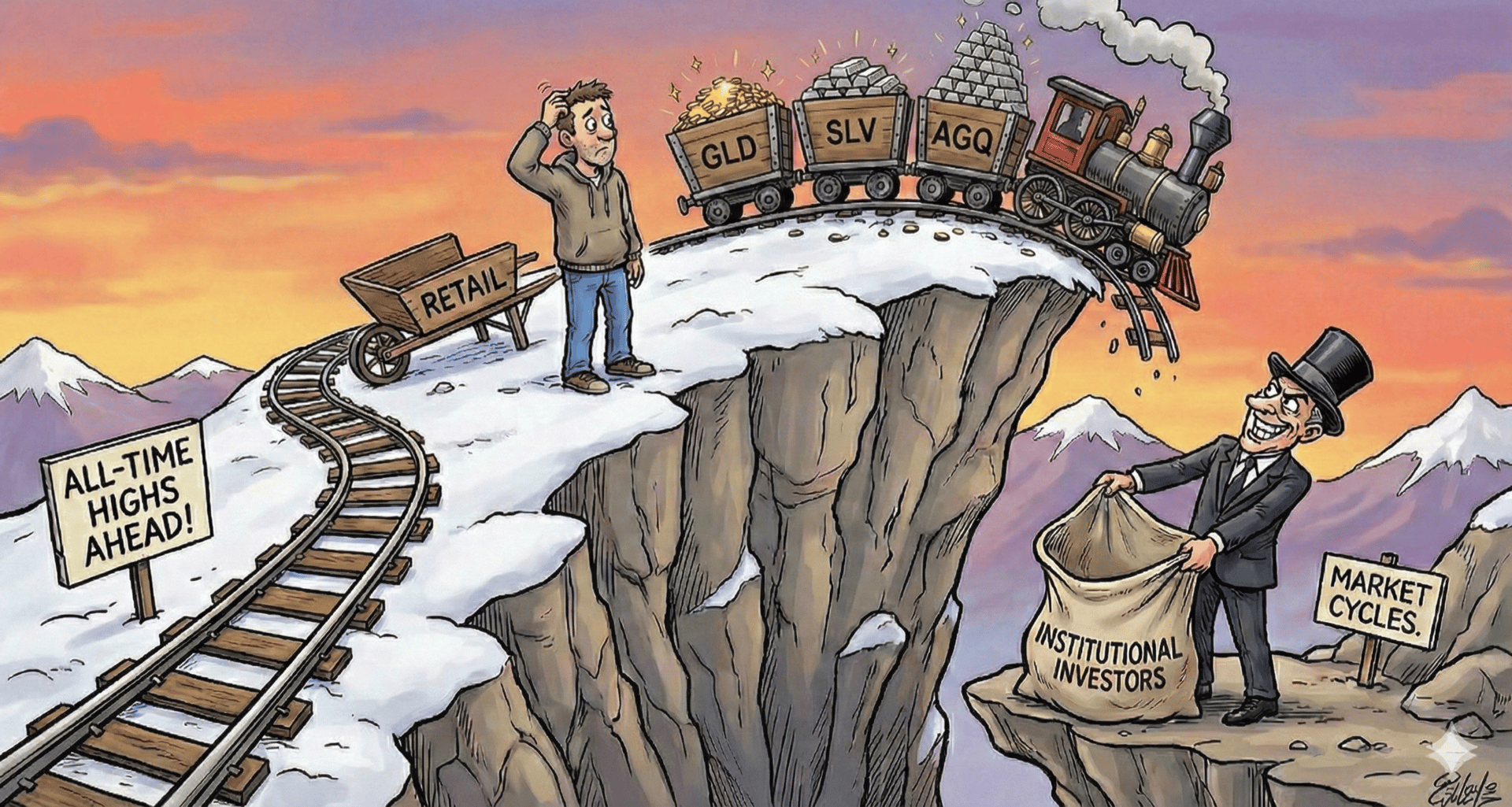

But Friday morning’s news was the pin that popped the balloon. Trump’s nomination of Kevin Warsh—a known hawk—sent the Dollar Index into a vertical spike.

Investors who were "long everything" suddenly faced a margin-call chain reaction, further exacerbated when the CME(futures trading exchange) announced at 2pm ET(likely as a reactive measure) that they would be hiking margin requirements of precious metals starting on Monday morning(2/2/26) forcing widespread liquidations. $3 Trillion in market cap was wiped out of precious metals in minutes.

The Data: AGQ’s 65% "Cliff Drop"

The Drawdown: AGQ (ProShares Ultra Silver) plunged roughly 60-65% in a single day (crashing from ~$400 to lows near $123).

The YOY Growth: Before this crash, AGQ was one of the best-performing assets on the planet, up a staggering 850% to 929% Year-over-Year.

The Lesson: This is the "Volatility Tax." Leveraged ETFs are wealth-building engines on the way up, but they are "wealth incinerators" when a macro regime change happens in a single news cycle.

The Feature: Lost in a Jungle of Funds

Most investors buy Gold (GLD) or Silver (SLV) as a safe haven and get 0% yield. Us high-yield income investors know how to generate income from "synthetic" gold and silver. (Go ahead, boast about that at your next family birthday party.)

The Basics: Know Your Metals

Before you buy, know the hierarchy of the market.

The Spot Price: $GOLD, $SILVER

The Base Metal (For Context): $COPPER. While not a "precious" metal, Copper is the veins of the AI/Data Center boom. It is currently rallying, and often leads the industrial cycle. Keep an eye on it.

The Physical ETFs: GLD, SLV, CPER.

The Miners (Naturally Leveraged):

Gold: GDX (Majors), GDXJ (Juniors) — Typically move 1.5x-2x of Spot Gold.

Silver: SIL (Global X Silver Miners), SILJ (Prime Junior Silver Miners).

The Leverage Lunatics (3x Funds)

Warning: These are not for income. These are for trading. They are the "Big Daddies" of volatility.

GDXU: MicroSectors Gold Miners 3X Leveraged ETN.

NUGT: Direxion Daily Gold Miners Index Bull 3X Shares.

JNUG: Direxion Daily Junior Gold Miners Index Bull 3X Shares.

SHNY: MicroSectors Gold 3X Leveraged ETN.

(Note: 3x Leverage means if Gold Miners drop 10% in a day, you lose 30%. Handle with care.)

1. The Gold Standard (Income Style)

How do the income heavyweights compare?

Ticker | Issuer | Strategy | Current Yield |

GDXW | Roundhill | Gold Miners 1.2x + Weekly Pay | 76.27% |

GLDW | Roundhill | Gold 1.2x + Weekly Pay | 35.64% |

IAUI | NEOS | Gold Strategy (Covered Call) | 12.53% |

KGLD | Kurv | Gold Strategy (Nav Protection) | 11.59% |

2. The Silver Streak

SLJY (Amplify Silver Junior Miners): A niche play for exposure to smaller, volatile silver companies. Current Yield: 19.28%.

KSLV (Kurv Strategy Silver): A cleaner way to get silver exposure without the "miner" risk. Current Yield: 18.52%.

3. Rare Earths & Critical Minerals (The "New Energy" Play)

REMX (VanEck Rare Earth): The "Daddy" of the space.

SETM (Sprott Critical Materials): The "Growth" engine, up nearly 128% in a yr.

The Context: Lithium, Cobalt, and Neodymium are no longer just commodities; they are National Security Assets. With the recent White House investment push into domestic mining and processing to break reliance on foreign supply chains, this sector is primed for a super-cycle.

Editor's Note: We are preparing a dedicated deep-dive article on the "Critical Minerals" opportunity soon.

The Income Gap: There is no high-yield/synthetic fund for Rare Earths yet. Mark my words: YieldMax or Roundhill will launch a "REMW" or "ZAPY" soon. Watch this space.

A YEAR IN GOLD REVIEW: The Analyst's Take

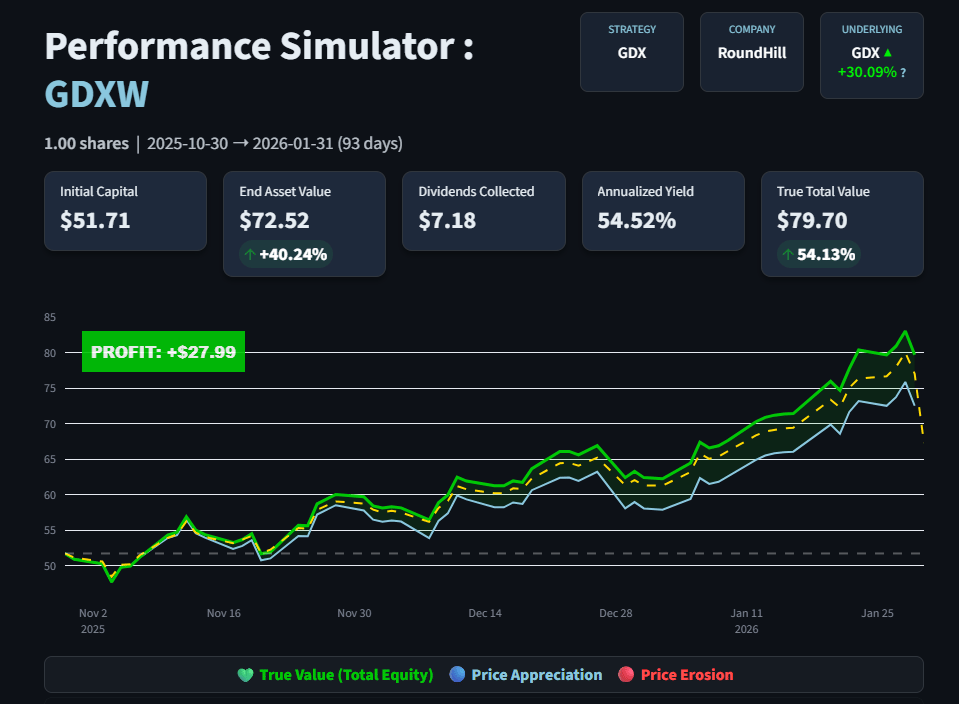

How did these funds stack up against one another and which one is right for your portfolio? Well, the analysis below speaks for itself. (I used the High Yield Terminal to do this analysis - you can too, just click here to access the app).

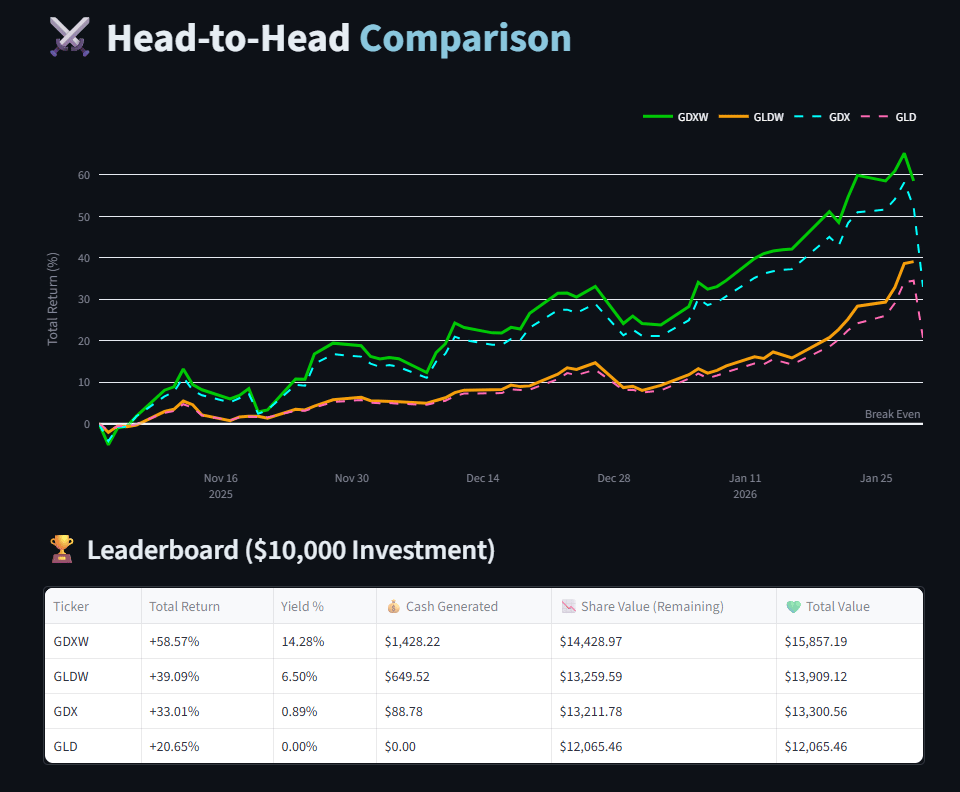

GDXW beats the underlying!!!!

The screenshot below shows Roundhill's gold miners 1.2x leveraged + income play beating its underlying ticker - yes, that's right. Roundhill's goal in the prospectus was to aim to beat the underlying, and in this case they have, and they've paid out a massive 54% yield (annualized) since inception while the NAV has grown by 40%.

The underlying Ticker(GDX) is the yellow line.

While GDXW’s price is lower(Blue) it has paid out more value in dividends(Green shaded area)

Miners beat Gold

These screenshots show you how gold miners are leveraged gold. This is not as extreme a case in silver or copper, but they still act a little more leveraged than their underlying.

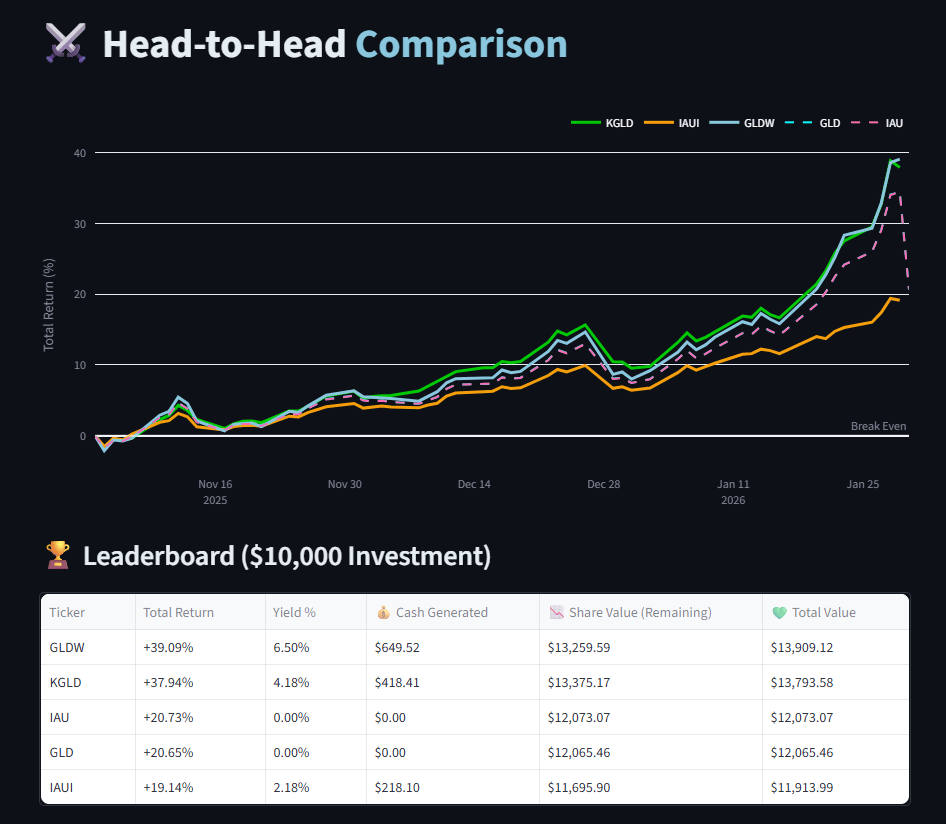

Kurv Beats Neos

In an absolute shocker, this reporter discovered that Kurv (KGLD) has completely outperformed Neos (IAUI) in the gold run. This is a shocker as NEOS index funds have done so well. Kurv's KGLD takes the ticker as the best GLD income fund - it's not as leveraged as a gold miner and will not erode as fast. The crash on Friday will show us, but this reporter's money is on Kurv to protect its NAV.

GLDW is in this screenshot too and has matched Kurv's returns on this ticker; however, GLDW is a 1.2x leveraged fund so the risks are higher, which is why I have chosen KGLD as the best investment out there for income-related gold exposure.

Winner of the Week:

Roundhill’s GDXW. Beating the underlying index while currently paying 76% annualized? That is the definition of having your cake and eating it too.

Time will tell what fund survives this week's crash. But like always, do your own research. Until next div date. Take care.

Want to analyze these funds yourself? Visit RetailInvestorReport.com to access the High Yield Terminal and master dividend investing today!

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice. All prices, yields, and performance data are as of January 30, 2026. The percentage yields shown may differ from what is displayed on the funds' official websites. While every effort is made to ensure accuracy, the High Yield Terminal displays yields based on a specifically selected timeline and uses the closing price of each day's historical price and paid dividends to calculate annualized yields. Past performance is not indicative of future results. Investments in precious metals and leveraged ETFs involve significant risk, including potential loss of principal. Consult a qualified financial advisor before making any investment decisions. The Retail Investor Report and its authors are not registered investment advisors.